Premium Sector Performance Evaluation on 4444117246, 946414289, 120663755, 120923095, 9124704053, 931654420

The evaluation of premium sector identifiers such as 4444117246, 946414289, 120663755, 120923095, 9124704053, and 931654420 reveals significant investment potential. Key performance metrics indicate varying levels of return on investment and market demand. Furthermore, user engagement trends suggest differing strengths among these identifiers. Understanding these dynamics is crucial for investors aiming to navigate the complexities of the market and maximize their portfolio outcomes. What specific strategies could be employed to leverage these insights effectively?

Overview of Premium Sector Investments

Although the premium sector has historically been associated with higher returns, its performance is influenced by various market dynamics and investor sentiment.

Premium investments require rigorous risk assessment, as fluctuations in economic conditions can dramatically affect profitability.

Investors must analyze historical trends and current market indicators to navigate potential pitfalls and capitalize on opportunities, ensuring a strategic approach that aligns with their financial goals and desired freedom.

Performance Metrics of Identifiers

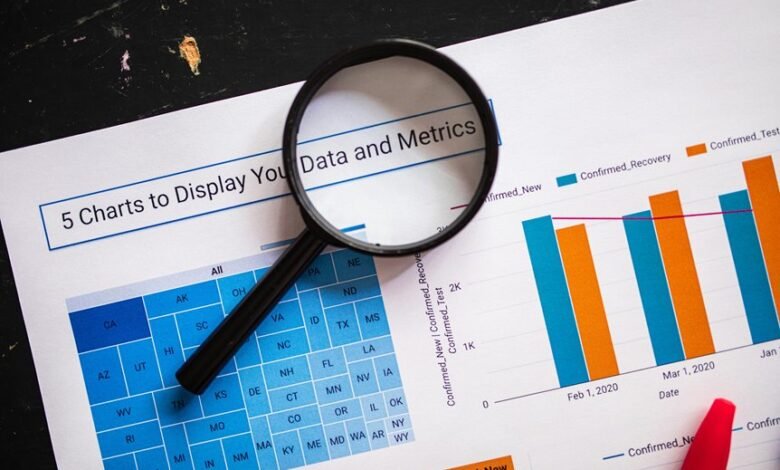

When evaluating the performance metrics of identifiers within the premium sector, it is essential to consider a range of quantitative and qualitative indicators that can provide insights into investment viability.

Identifier analysis enables robust performance comparison, highlighting strengths and weaknesses. Metrics such as return on investment, market demand, and user engagement facilitate informed decision-making, offering stakeholders the freedom to navigate investment opportunities effectively.

Market Trends and Insights

As the premium sector evolves, understanding market trends and insights becomes crucial for stakeholders aiming to optimize their investment strategies.

Current market dynamics indicate a shift towards sustainability and technology integration, influencing consumer preferences.

Data-driven analysis reveals emerging opportunities in niche markets, prompting investors to refine their strategies.

Adapting to these insights enables stakeholders to navigate complexities and enhance portfolio performance effectively.

Strategic Implications for Investors

Understanding the strategic implications for investors in the premium sector requires a careful analysis of emerging trends and consumer behaviors.

Investors must conduct thorough risk assessments and develop robust investment strategies to navigate market volatility.

Conclusion

In conclusion, the contrasting performance of premium sector identifiers reveals a landscape rife with both opportunity and risk. While some identifiers exhibit robust returns and strong market demand, others falter, highlighting the necessity for meticulous analysis. This duality underscores the importance of strategic adaptability for investors; those who leverage insights from performance metrics can navigate market fluctuations more effectively, turning potential pitfalls into pathways for enhanced portfolio optimization. Thus, informed decision-making remains paramount in this dynamic investment environment.